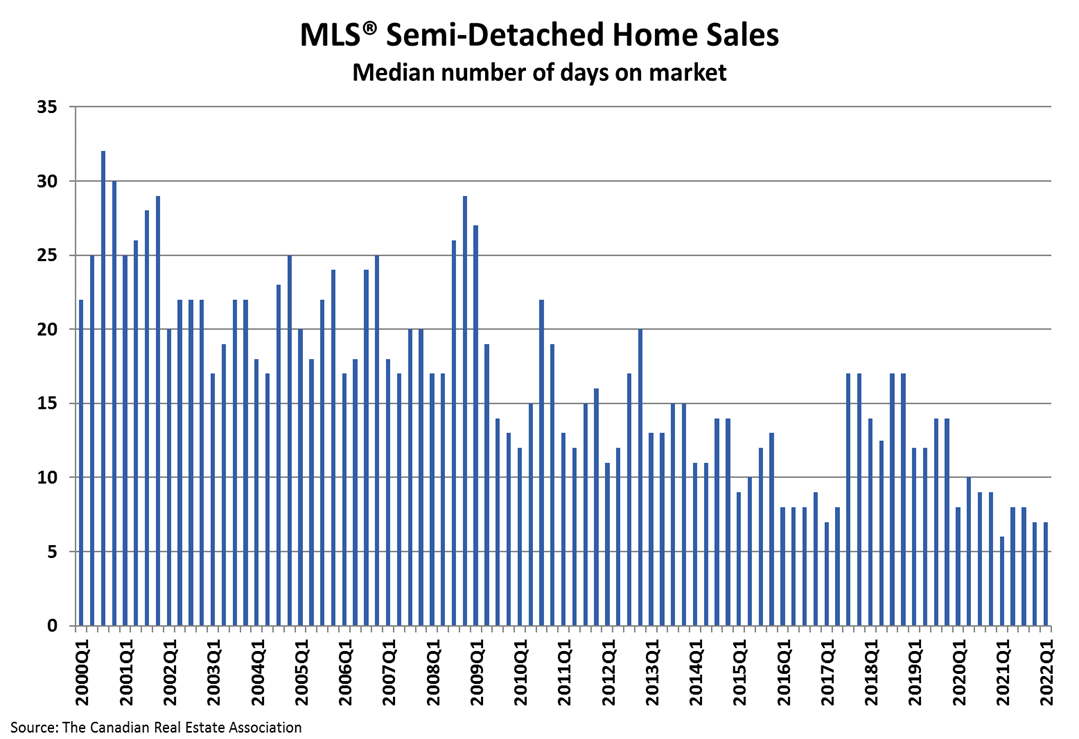

You may be surprised to learn the truth about costs when it comes to hiring a real estate lawyer. Upfront quotes from firms that promise affordable rates may be tempting, but you need to know all the facts if you are going to make an informed decision. And, with real estate in Toronto being on the market for an average of 7 days, you can’t afford to wait.

If you live in Ontario, the fact is, you may need a real estate lawyer at some point in your life. Knowing all the ins and outs of the process, you will be better able to make the right decision. The real costs of hiring a real estate lawyer in Ontario is a multi-faceted answer, but learning it can give you leverage if you ever need to decide to hire a real estate lawyer in the future. This is especially important when you’re a first-time homebuyer.

Let’s look into the specific fees associated with hiring a real estate lawyer in Ontario, but first, let’s look at why you may need a real estate lawyer if you’ve never thought of hiring one before.

Why Hire a Real Estate Lawyer?

Whether buying or selling residential or commercial property, expert advice from a real estate lawyer is a valuable tool to consider. There are many intricacies a lawyer will be trained to root out, that ensure smooth contract negotiations and what they actually help with varies based on your goal to buy or sell.

When Buying

The main document you need to complete when purchasing a house is the purchase contract, and as with any contract, it is good practice to seek advice from a lawyer before entering into any written agreement. Also, real estate agents are great at filling out contract templates, but if you need more complex contracts, you’ll need to rely on an attorney. Allow for a few days of review before the contract is finalized to allow the attorney a comprehensive review.

When Selling

There are many different documents involved with the sale of a property, and expert advice from a real estate lawyer can help. They can help draft the deed, and the Statement of Adjustments and help with the final monetary arrangement.

Now to the heavy question, what does it cost to hire a real estate lawyer in Ontario?

How Much Are Real Estate Lawyer Fees in Ontario?

When considering the costs of hiring a real estate lawyer, there are a few fees you need to keep in mind: closing fees, refinancing fees, purchasing fees, and the cost to register a property in Ontario.

Closing Fees

A typical guideline used to figure the average closing costs for a property in Ontario is to expect costs anywhere between 1.5% and 4% of the final purchase price. One of the determining factors, the property purchase price, can range in cost between $7,500 and $20,000.In general, when talking about closing costs, we are referring to a sum of:

- Land transfer tax

- Real estate lawyer fees

- Expenses

- Costs

These fees are paid at the time of purchase and do not include the purchase down-payment.

At a minimum, you can expect to pay for Province and Municipal land transfer taxes, lawyers’ fees plus disbursements, title and fire insurance, registration of transfer or mortgage, and a possible Stewart Assyst Charge of just over $30, if mortgage information is sent electronically.

Refinancing Fees

If refinancing a property, there is a list of varied fees and costs you can expect.

First, you must pay the parties involved in the transaction; so, there are potentially mortgage broker’s commissions and real estate lawyers’ fees. Then you need to consider the amount of credit that needs to be paid off, including the existing mortgage, any credit cards, and lines of credit. Then you will still need to pay for the standard fees like title insurance and the registration of refinancing fees. There is also a law society levy as well.

All of these costs together, represent the total costs you can expect if refinancing a property in Ontario.

Purchasing Fees

When it comes down to the purchasing fees, you will need to first consider the selling price of the property. The down payment you contribute towards that amount is considered your purchasing fee. Typically, the mortgage will be written for any remaining amount.

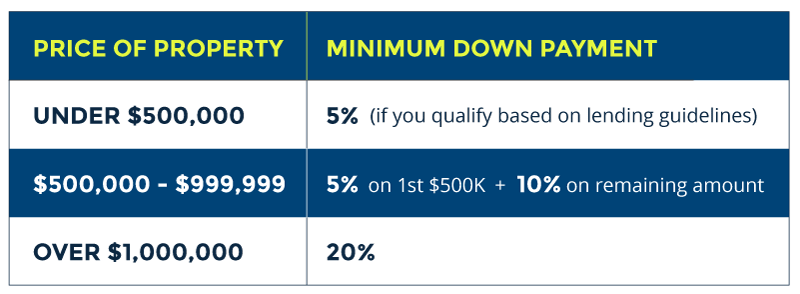

Actual costs will vary based on credit score, but if you live in Ontario, Canada, the purchase fee requirements are on a sliding scale based on the final purchase price of the property. Below are the general guidelines.

Home Purchase Cost and Down Payment Required

- $50,000: 5%

- $50,001 – 999,999: 5% of the first $500,000 and 10% for the portion above $500,000

- $1,000,000: 20%

Registering a Mortgage

In Ontario, there are two main ways to register a mortgage: via standard charge or a collateral charge. A charge on the title of your deed means you are not able to sell the property or make changes to the title without letting the lender know.

A Standard Charge is a favoured way to handle this charge in Ontario. With this charge, you have the option to switch or renew with another lender without triggering legal fees, so you have flexibility in lenders.

The standard charge is based on the amount borrowed, not the value of the home, so it will mean less home equity. If you want to borrow against this amount, you have the option of a “second position” mortgage, which would either replace or cancel the existing mortgage, triggering l

With a collateral charge mortgage, you will not have transferrable rights to choose other lenders. If you decide to change, you will incur legal fees and a new mortgage registration fee.

The benefit of a collateral charge mortgage is that it is made based on 100% and up to 125% of the value of the property, so your home equity remains intact. This is a valuable option for those looking to tap into the equity for renovation, investments, and debt consolidation, but it comes with its caveat. When the initial loan is processed, any future loan on the equity will be based on either the value of the collateral charge or up to 80% of the equity; whichever is lower. The only way to increase this amount is to continue paying against the note, which will increase the value of the home, increasing equity as well.

Other Costs to Hire a Real Estate Lawyer in Ontario

The only other costs you would need to consider when hiring a real estate lawyer in Ontario are associated with the lawyers’ fees.

Many lawyers charge a flat fee, anywhere from $90 to $2,000 to handle this kind of transaction, while others favour an hourly rate for their services. Either way, you can expect to spend $2,000- $5,000 between lawyer flat fees and the fee they charge for registering the mortgage on their behalf. Also, depending on how complex your transaction is, you may incur additional charges if there is additional paperwork to draw up.

Ultimately, the cost of hiring a real estate lawyer in Ontario is well worth the expense when you consider the trouble you may encounter without a trained professional. As with any legal agreement, it is a better idea to stomach the upfront costs associated with hiring a professional, than risk the damages caused without one.

If you need a Toronto real estate lawyer to help you with buying or selling a property, contact us today for a free consultation.