There are many fees to consider when buying a house in Ontario. The list of fees below is not exhaustive, but it will give you an idea of some of the most common ones. It’s important to be aware of all the potential costs involved in any real estate transaction, in order to plan your purchase wisely and stay within your budget. So, without further ado, here are some of the most common fees involved in buying a home in Ontario.

1. Land transfer tax

The land transfer tax is a tax that is paid by the buyer of the property at the time of closing. The amount of tax that is payable depends on the value of the property. The provincial government imposes a land transfer tax, and some municipalities also charge their own land transfer tax. For example, in Toronto, the provincial land transfer tax is calculated as follows:

- 0.005% on the first $55,000

- 0.01% on the next $345,000

- 0.025% on any amount over $400,000

For properties worth more than $400,000, this comes to a maximum Land Transfer Tax of $13,050. First-time home buyers in Ontario may be eligible for a rebate of up to $4000 on their land transfer tax.

So, if you’re planning on buying a home in Ontario, be sure to factor in the cost of the land transfer tax. It can add up to a significant amount, especially if you’re purchasing an expensive property.

2. Home inspections

When you buy a home, the last thing you want is unexpected problems. That’s why it’s a good idea to get a home inspection before you finalize your purchase. A home inspector will look for any potential problems with the property, such as structural issues, mould, or electrical problems. Home inspections can cost between $300 and $500, depending on the size and age of the property.

While a home inspection is not required, it is highly recommended, especially if you’re buying an older home. It’s better to be aware of any potential problems before you finalize your purchase, rather than finding out after the fact.

3. Property appraisals

If you’re getting a mortgage to finance your home purchase, your lender will require a property appraisal. The purpose of the appraisal is to determine the value of the property, in order to ensure that the loan amount is appropriate. Property appraisals can run you $300-$400.

While the cost of a property appraisal may seem like an unnecessary expense, it’s important to remember that it is required by your lender. Without it, you would not be able to get a mortgage.

4. General home maintenance

Once you buy your dream home, there of course is general maintenance and repairs to keep the property in tip-top shape. Depending on the size of your home, and how well it was maintained by the previous owners, you can expect to spend 1% of the property value per year on general maintenance and repairs.

5. Water quality inspection

If you’re buying a home that is not connected to municipal water, you will need to have the water quality inspected. The purpose of the inspection is to ensure that the water is safe for human consumption. Water quality inspections cost between $200 and $300.

6. Real estate lawyer

Hiring an Ontario real estate lawyer is one of the best investments you can make during the home buying process. A qualified lawyer like ours at Prudent Law will help you make better decisions, file paperwork, and speed up the process of purchasing your dream home. While the cost of hiring a real estate lawyer varies, you can expect to pay around $1,000 for their services. Read our article on the costs of hiring a real estate lawyer to learn more.

7. Fire insurance

If you’re getting a mortgage to finance your home purchase, your lender will require you to have fire insurance. Fire insurance protects your home and belongings in the event of a fire. The cost of fire insurance varies depending on the value of your home, but it is generally around $100/year.

8. Property taxes

In Ontario, property taxes are levied by the municipality in which the property is located. Property taxes are based on the assessed value of the property and are used to fund local services like schools and libraries. The amount of property tax you will pay relies on the value of your home and the municipality in which it is located. For example, in Toronto, the average annual property tax bill is $3,619.

9. Title insurance

Title insurance protects you from any financial losses that may occur as a result of problems with the title to your property. The cost of title insurance varies depending on the value of your home, but it is typically around $200.

10. Property survey

A property survey is a document that shows the legal boundaries of your property. The cost of a property survey varies depending on the size and complexity of the property, but it is typically around $500.

11. Costs of moving to your new home

When purchasing a new home, you have to move things like furniture, personal belongings, and other items. Unless you plan to do this yourself, you will need to hire a moving company. The cost of hiring a professional moving company varies depending on the size of your home and the distance you are moving. For example, the average cost of hiring a professional moving company to move a three-bedroom home within Ontario is $1,300.

12. Connecting utilities

Your new home will need utilities like electricity, water, and gas. The cost of connecting these utilities varies depending on the provider and the services you are requesting. For example, the cost of connecting hydro (electricity) in Ontario ranges from $40 to $180.

13. Mortgage insurance premium

In Ontario, you must provide at least 5% down when purchasing a home. If you do less than 20%, your lender will require you to get mortgage insurance. Mortgage insurance protects the lender in the event that you default on your mortgage. The cost of mortgage insurance varies depending on the amount of your down payment, but it is typically around $100 per month.

14. Real estate agent

Searching for homes, putting in offers, and doing viewings isn’t easy. That’s why a trusted real estate agent is a good decision. In Ontario, realtor fees are baked into the transaction. As a buyer, you pay for the commission fees when purchasing a home so you must consider it.

15. Renovations

If you’re planning on doing any renovations to your new home, you need to factor in the cost of materials, labour, and permits. The cost of renovations varies depending on the scope of the project, such as painting, adding a deck, re-doing your basement, etc.

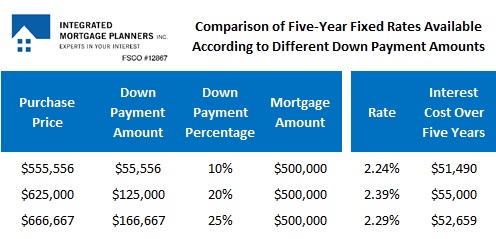

16. Down payment

The minimum down payment in Ontario is five percent of the purchase price. For example, if you’re buying a home for $500,000, your minimum down payment would be $25,000. If you have a down payment of less than 20%, you will also have to pay for mortgage insurance (which is typically around $100 per month). Here’s an example of down payment amounts, various purchase prices, and interest rates.

17. Mortgage penalties (if changing mortgage loans)

If you’re changing mortgage loans, you may have to pay a penalty. Mortgage penalties are typically three months’ worth of interest or the interest rate differential (IRD), whichever is greater. The IRD is the difference between your current mortgage rate and the new mortgage rate. For example, if your current mortgage rate is three percent and your new mortgage rate is two percent, your IRD would be one percent.

Final thoughts on home buying fees in Ontario

There are many fees involved in buying a house in Ontario, but knowing about them helps you plan your finances more wisely. Title insurance, property surveys, moving costs, and utility connection fees are some of the less obvious costs associated with purchasing a home. Additionally, don’t forget to factor in the cost of real estate agents and renovations when budgeting for your new home. Lastly, be aware of mortgage penalties if you’re changing mortgage loans. With all these factors considered, you’ll be on your way to becoming a savvy home buyer in no time.

If you need help buying or selling property, get in touch with one of Prudent Law’s real estate lawyers today.